Pivot Payables Joins American Express Sync™

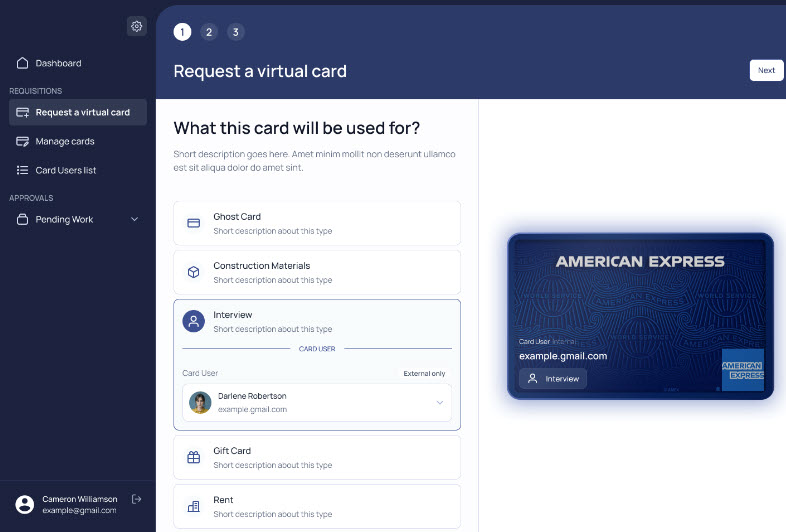

B2B payments collaboration provides PivotLynx users more ways to manage expenses, payments, and cash flow management with on-demand virtual Cards.The integration offers U.S. Business and Corporate Card Members the ability to generate virtual Cards within PivotLynx, Pivot Payables’ accounting automation application, ensuring requests are routed to managers for budget approval and cost accounting and virtual Card spending controls are individually applied. At statement closing, PivotLynx automates the reconciliation between the Card statement and the general ledger, eliminating manual accounting steps.

Enrollment required and fees may apply.

Eligible American Express Card Members using virtual Cards in PivotLynx can:

- Establish specific controls for each on-demand virtual Card payment, including setting spending limits or expiration dates, and changing controls or deactivating on-demand virtual Cards at any time.

- Help manage budgets specific to projects and maintain visibility and control over spending with spending limits and expiration dates.

- Establish specific controls for each on-demand virtual Card payment, including spending limits, expiration dates and allowed merchant categories.

- Access virtual Card transaction data within the PivotLynx platform, reducing manual processes and improving reconciliation.